I hear the words “student loans” and I shudder. We’re only approaching 2nd grade, but so many questions fill my mind about college savings. So, when given the opportunity to get some answers from Joe DePaulo, CEO and Co-Founder of College Ave Student Loans, a student loan marketplace lender focused on funding higher education costs – I jumped on it!

What are your thoughts on 529 plans in general? Are they worth it?

A 529 plan is a good option to save for college. Even if you’re not sure what path your child will take, a 529 plan can be used for almost any post-high school education. It’s not just for traditional four-year universities.

What are key things to keep in mind if your child needs to take out student loans?

First, encourage your child to think about their career goals. When deciding where to go to college or how much to borrow to pay for college, consider the goal – what type of career do they see in their future? It’s okay if they are not exactly sure yet, but having an idea of their future earning potential will help them plot the best way to get there. It’s a general rule of thumb not to borrow more for school than they expect to make in the first year of their professional career.

Second, help them fill out the FAFSA. The Free Application for Federal Student Aid, or FAFSA, is always the best place to start. You’ll make sure your child doesn’t miss out on any federal aid, and it will help schools prepare your financial aid packages.

Third, if you need private student loans, make sure everyone understands the cost of the loan and how to manage it. No one wants to pay more than they have to for student loans. We often talk about the total cost of the loan, which is the amount borrowed plus any interest charges that are applied over the life of the loan. That means the quicker the student pays the loan back, the more he or she will save in interest charges, and the lower the total cost. Look for a provider that offers flexible repayment options and rewards you for paying during school. For example, at College Ave Student Loans, we offer choices of how and when you pay back the loan, plus we offer low variable rates. If the student or the cosigner commits to in-school payments (even just $25 each month), you’ll get a lower rate. Check out our student loan calculator to understand how our options can help your student control the cost of the loan.

Also, there are so many student loans out there, so shop around. With so many options, it doesn’t make sense to pay for a loan that has origination fees or fees if you pay your loan back early. At College Ave, we make it clear and easy to understand the student loan lending process through our innovative tools section. Check out our student loan calculator (mentioned above) and our credit pre-qualification tool that will help determine if your credit qualifies for a loan and what rates you can expect all without affecting your credit score.

What about co-signers of student loans?

If you’re planning to be a cosigner, prepare your credit. If you think you may need to cosign a private student loan for your child to help cover the cost of the upcoming school year, prepare your credit the same way you would before applying for a mortgage. Get a copy of your credit report from all three credit bureaus to review your FICO scores and make sure there are no errors. Be cautious about taking on other large debts. Managing your credit can ultimately help you and your student get approved for the loan, and lower the interest rate.

Looking for more parenting tips?

- 3 Things We Do Regularly Because We’re Saving For College

- 5 Attitude Makeovers For Moms

- Why Net Neutrality is Essential For Mom Bloggers

- My Thoughts on Blogger Transparency

- Setting Up a Plan to Finish the School Year Strong

- How to Successfully Get Through Parent Teacher Conferences

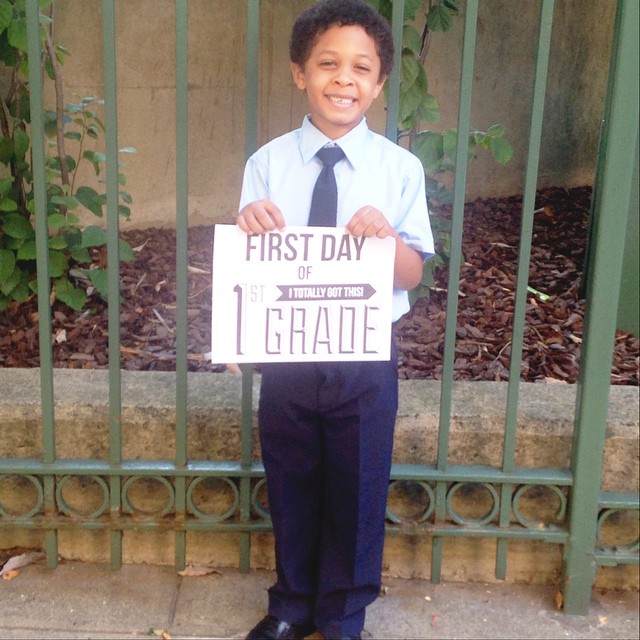

- Branden’s First Day of Kindergarten

Fashionably Yours,

Allison

***This is a sponsored post. As always, opinions are my own. ***

I wish I had known some of these tips when I applied for student loans! I fear I will be paying them off for the rest of my life! I’ll pass this along to my sisters, one who just graduated and another who will graduate next year!

The boychild is small but now is the time to start preparing for these situations. thanks for the reminder, I’m going to get on it this summer.

It took me forever to pay off my student loans. I hope my kids get LOTS of scholarships LOL 🙂

Ahh, student loans can be such a scary thing! This sounds like great advice to help prepare for it.

I have never gone to college or applied, so I have no idea how financial aid or anything works but I know that student loans can pile up! This is a great post full of advice once my kids go to college

My oldest is going to college this fall. Ahhh its so scary. We’re going to try and pay everything off as he goes, hoping the plan we have in place works.

My little is just starting Kindergarten this year, so of course I am already planning for college! LOL I do plan on doing whatever I can to ensure he is able to pursue whatever career or job that he desires.

These are some good things to think abut when considering student loans. It’s a huge decision!

I keep feeling like it’s so far away, but I know college will be here in an instant. I need to get ready!

Getting advice from reliable sources is so important in the journey to getting a student loan. I know a few people who jumped on impulse and didn’t research it through, who’re now suffering the consequences..

Honestly, I have never been to college, but I have heard that student loans can be something else! These are wonderful tips, though.